Picture this: You’re sifting through the murky waters of VA disability compensation, and there it is—the 2024 VA Disability Calculator, a beacon in the fog, promising to make sense of those confusing numbers. It’s like finding a trusty compass when you’re lost at sea.

That first time you look at your disability rating and think, “What now?” But imagine having a tool that simplifies all that math—yes, even that oddball VA math—and spells out what you stand to get each month.

Let us tell you, diving into this can turn up some real treasures. From figuring out how much extra cash could come from dependents or special circumstances like sleep apnea to keeping pace with inflation thanks to cost-of-living adjustments—it’s all here.

You might be wondering just how much more your pocket could swell if everything lines up right… Stick around—We’ve got some insights that’ll do more than just float your boat!

Calculating Your VA Disability Compensation for 2024

If you’re a vet, figuring out your VA disability compensation can feel like trying to solve a Rubik’s Cube blindfolded. But fear not. With the right tools and info, you’ll be navigating this labyrinth like a pro. First up, let’s talk about your basic rate.

The magic number that kicks off the whole shebang is tied directly to your combined va disability rating. Think of it as the base from which all else springs—like sourdough starter but way less tasty. The monthly payment you get hinges on this rating plus any dependents hanging their hats at your place.

Say you’ve got kids or dependent parents; well, they count too when we tally up what lands in your pocket each month. And if by chance your spouse is getting aid because they need more help than most? That sweetens the pot even more with extra dough rolling in (and who doesn’t love that?).

Mastering VA Math with the Combined Ratings Table

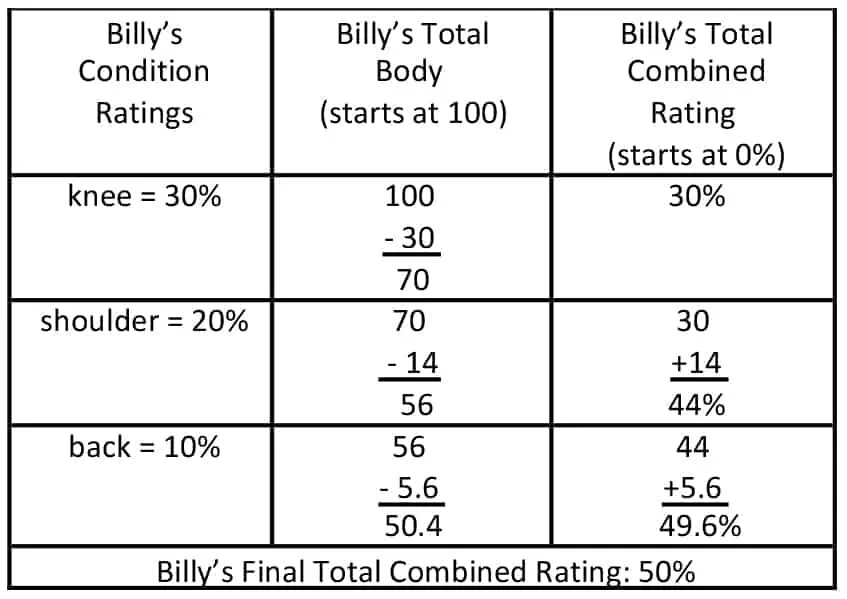

Think of your combined VA disability like a pie. Not just any pie, but one that’s shared at a family reunion—everyone wants a piece, and some slices are bigger than others. That’s how the VA math works when combining multiple disabilities.

Your overall rating isn’t as simple as adding up each slice; it’s more complex because the VA uses percentages of percentages to calculate your final number. Let’s say you have two ratings: 50% for an injury sustained during service and 30% for chronic back pain developed after discharge. The first condition gets half the pie, but then the second only applies to what’s left—not to mention if you’re close to that elusive 100%, where every crumb counts even more.

This layered approach ensures fairness in compensation rates and recognizes varying degrees of impairment without overstating their cumulative impact—a balance between giving credit where due while preventing inflationary effects on total disability ratings. And remember, these figures directly affect your monthly payment.

Maximizing Your Monthly Payment with Additional Factors

Squeezing every last penny out of your VA disability compensation is like finding hidden treasure in your own backyard. If you’ve got sleep apnea or another qualifying condition, that’s more dough in the bank each month. But wait—there’s more. Imagine adding a cherry on top if your spouse gets Aid and Attendance benefits.

Children are an invaluable asset, not only providing joy but also offering financial benefits from the government. They also bring home extra bacon when it comes to additional monthly payments from Uncle Sam. It turns out having multiple children isn’t just about minivans and bulk shopping—it can mean serious moolah for your family.

Buckle up because these aren’t just empty words; we’re talking cold hard cash based on actual figures in line with Social Security adjustments. A higher rating due to specific conditions means bigger checks coming your way—a real game-changer for those who served our country bravely.

Understanding Cost-of-Living Adjustments (COLA)

Vets comprehend that every cent matters when managing their disability remunerations, particularly with respect to keeping up with the everyday challenges. That’s where COLA swings into action like a financial superhero, making sure your VA compensation doesn’t lose its muscle against inflation. The government gets this and has legally tied Social Security benefits adjustments to those of veteran compensation rates.

Catch this: without these annual tweaks based on cost-of-living changes, you might find yourself squeezed tighter than a new recruit’s haircut. Imagine if your monthly tax-free payments stayed flat while everything from milk to mortgage got pricier? Not cool. But thanks to COLA, veterans can breathe easier knowing their purchasing power won’t go AWOL over time.

Maximizing the value of your benefits is paramount. Whether it’s Social Security or VA disability pay we’re talking about here—understanding how COLA affects both is crucial for budgeting better than a quartermaster.

Utilizing Online Tools for Accurate Benefit Estimates

If you’ve ever felt like calculating your VA disability compensation is a puzzle, fear not. The digital age has brought us tools that make cracking the code on your potential benefit amount easier than finding where Waldo’s hiding. For instance, Hill & Ponton’s calculator isn’t just another online gadget—it’s a beacon in the murky waters of VA math.

This handy tool complements official resources such as The Combinator, an official aid from the VA designed to help veterans pin down their combined ratings with precision. Imagine having a sherpa guiding you up Mount Everest—that’s what these calculators do for navigating through complex percentage combinations and dependencies.

Let’s be real; there are more layers here than in grandma’s lasagna when it comes to factors affecting your monthly tax-free allowance. And just like any good recipe, knowing all ingredients is crucial—which includes understanding how dependents can sweeten the pot or how conditions like sleep apnea might bump up those numbers even higher.

Exploring Dependent-Related Benefits in Detail

If you’re a vet with loved ones relying on you, it’s key to know how dependents can bump up your monthly VA benefits. Think of your family as extra seasoning that spices up the stew of your compensation—each dependent adds a little more flavor (aka cash) to the pot.

Got kids? They’re not just adorable; they’re also dollar signs when it comes to disability pay. Same goes for a spouse or even dependent parents—you heard right, Mom and Dad could mean more moolah if they rely on you. And let’s say your other half needs some extra help around the house (we’re talking Aid and Attendance level), that’s another potential boost to what hits your bank account each month.

Your base payment is like a pizza—the size depends on how disabled Uncle Sam says you are. But adding dependents is like throwing on toppings, making that pizza bigger and better without changing its basic shape. Just remember: It’s all about getting every last bit of cheese—that sweet, sweet tax-free cheddar.

Conclusion

So, you’ve navigated the VA disability maze with precision. The 2024 VA Disability Calculator is your ally, turning complex numbers into clear-cut figures. Remember, every percentage point counts towards your monthly compensation.

Dive deep into dependent benefits; they can buoy up your payment significantly. Tackle that combined rating table—VA math won’t stand in your way anymore.

Stay alert to cost-of-living adjustments. They’re like annual waves lifting you just a bit higher each time, ensuring you stay afloat financially.

Now go forth and claim it!